Elevate your business with

Optimise's

lending solution

Elevate your business with

Optimise's lending solution

Optimise CRM

Aggregator

Professional Development

Compliance

Lead Generation

Car Buying

Optimise CRM

Aggregator

Professional Development

Compliance

Lead Generation

Car Buying

Optimise CRM

Optimise CRM

Discover a powerful asset finance broker software solution, driven by the world’s leading CRM, salesforce.com. Gain a competitive edge to expand, succeed, and close more deals.

Enterprise Level CRM system

AFOS is our custom CRM and the most powerful asset finance management platform in Australia. Designed by brokers, for brokers, it’s engineered to help you increase your productivity and boost your revenue.

Our system offers lead, opportunity and account management with a 360° view of your customer’s profile, as well as templates, digital scripts, information capture forms and more to help streamline the application, verification and settlement processes.

Enterprise Level CRM system

AFOS is our custom CRM and the most powerful asset finance management platform in Australia. Designed by brokers, for brokers, it’s engineered to help you increase your productivity and boost your revenue.

Our system offers lead, opportunity and account management with a 360° view of your customer’s profile, as well as templates, digital scripts, information capture forms and more to help streamline the application, verification and settlement processes.

White Label Referral Portals

Lender Matching Engine

Direct Lender API submissions

Our CRM has in-built lender APIs, allowing you to submit and monitor applications directly through our software.

Customised to your own brand

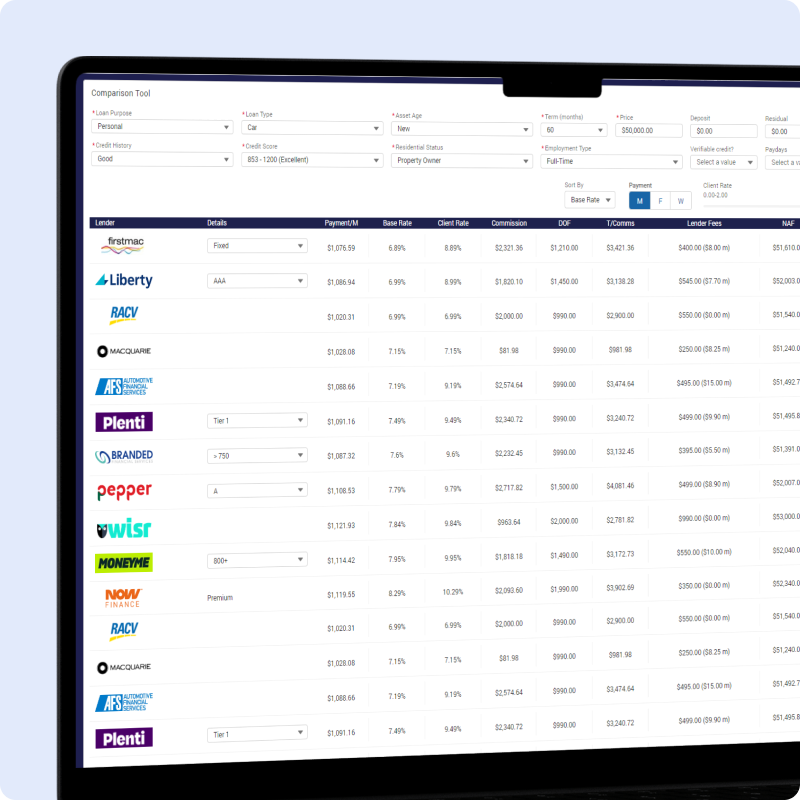

We provide white label capture forms, comparison tools and a customer portal you can deploy quickly and easily within your website and all marketing materials to align with your business’ image.

Electronic doc request & sign

All the required document submissions and signatures from your customers can be completed online, making the process more convenient for you and your clients.

Automated NCCP Compliance

You’ll be able to take advantage of automated NCCP compliance, which includes responsible lending, document creation and auditing requirements, so you won’t have to waste time and energy ensuring everything is up to scratch.

Glass’s Guide & Redbook vehicle search tools

We’ve also incorporated both Glass’s Guide and Redbook into our software, enabling you to quickly and easily conduct vehicle searches for your clients.

Automated Communication platform

You can save crucial time and effort on attempting to reach your clients through our CRM’s automated communications, including SMS, emails, follow-up correspondence and document collection.

Optimise Aggregation: Unlock the true potential of your business with our revolutionary solution.

Optimise Aggregation:

Unlock the true potential of your business with our revolutionary solution.

Because we’re partnered with such a vast range of commercial and consumer lenders, you can convert more deals for a more diverse set of customers.

Professional Development

Effortless

Compliance

Lead Generation

Lead Generation

Access to Verified Quality Leads

We offer access to high-quality, verified leads, so you can save time on searching for speculative opportunities and turbocharge your business.

Car buying

Through both our in-house car brokerage and seamless integration of Glass’s Guide and Redbook, finding vehicles for your clients has never been easier.

Car buying

At Optimise, we prioritise your professional development. You’ll receive ongoing support to meet your required CPD points. Additionally, we offer opportunities to expand your knowledge through our events and PD days.